Abstract

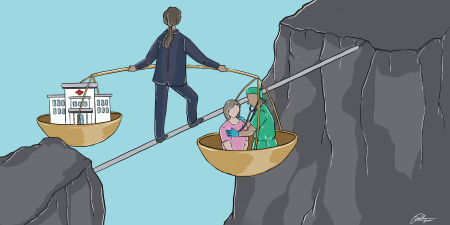

Negative health consequences stemming from the financial burden of care on patients and their loved ones are documented as financial toxicity in the literature, and these consequences should be included in informed consent discussions during patient-clinician interactions. However, codes of medical ethics have yet to require obtaining consent to financial costs, even as the No Surprises Act, effective on January 1, 2022, requires some clinicians to facilitate informed financial consent prior to an out-of-network elective service as a means of avoiding arbitration. This article discusses how this requirement can be more broadly applied to informed consent for any intervention.

Envisioning Informed Financial Consent

The uncomfortable reality that the financial toxicity of medical care is a significant source of patient harm is increasingly recognized in the medical literature.1,2,3,4,5,6,7,8 In fact, clinicians’ failure to disclose the likely cost of care during informed consent discussions has fueled the disreputable business practice of surprise medical bills, which charge well above market-level prices for services that the patients never assented to; indeed, surprise bills often demand payment amounts to which no informed purchaser would ever agree and are frequently followed by aggressive collection actions.9

The financial burden of health care remains an ethical blind spot for the entire US health care sector. One of the paramount tenets of medical ethics is to ensure that patients are adequately informed before consenting to medical treatment. The doctrine of informed consent, along with communication with patients and shared decision making, constitutes the entirety of the second chapter of the American Medical Association (AMA) Code of Medical Ethics.10 Although this chapter speaks frequently of treatment (mentioned 34 times) and intervention (mentioned 21 times), there is not a single reference to cost, price, or pay. Even AMA Code Opinion 11.3.1, “Fees for Medical Services,” does not require disclosure of a payment amount in advance.11 Thus, there is a gap between how costs are handled in medical ethics and how much real harm costs inflict on patients’ health and well-being. The consequences are even more profound, given the uncomfortable reality that the nation spent approximately 19.7% of its gross domestic product on health care in 2020—and more than double the average of 11 other wealthy Organisation for Economic Co-operation and Development (OECD) countries in 2015—thereby crowding out socially needed investments in education, childcare, and other social determinants of health.12,13,14,15

It is time for the medical profession to double down on its long-standing and admirable commitment to patient autonomy by including informed financial consent as a critical component of its foundational definition of informed consent. In other words, a physician’s ethical obligation to a patient should include adequately informing the patient of any financial consequences of nonurgent medical care before that care is provided. Informed financial consent has been described by Richman et al “as an essential element of medical practice [that] would both fulfill the profession’s ethical commitment to patient autonomy and provide a much-needed market-based counterforce to price escalation.”16 Richman et al argue that patients and their clinicians and provider organizations have an implied contract when clinical services are provided and that an essential element of any contract is the price for a service. If a price is not established before a service is provided, providers should be compensated based on the market price of a service, not their charge for that service.

The No Surprises Act, effective on January 1, 2022, requires some clinicians to facilitate informed financial consent prior to an out-of-network elective service as a means of avoiding arbitration. Here, we discuss how this requirement can be more broadly applied to informed consent for any intervention.

Harms of Inadequate Informed Consent

The lack of an informed financial consent obligation is acutely evident in today’s health care marketplace. Receiving health care in the United States places a patient at significant, and often undisclosed, financial risk. The charges for health care services are calculated in arrears after the services have occurred. The financial obligations of patients vary significantly based on the provider charge (or the list price for the service set by the physician or hospital), whether the provider was contracted with the health plan (as an in-network provider and at a contracted in-network price), and the details of the plan provisions for payment. Financial toxicity can be further exacerbated by benefit designs, such as high-deductible health plans that place first-dollar payment responsibility on patients, even when they have health insurance. The financial sequela of medical debt can include considerable distress,1,2,3,4 personal bankruptcy,5 and lasting impacts on the patient and their family members.6,7 Severe financial distress can also have direct and long-term health effects on patients, as it is a risk factor for mortality in cancer patients.8 In sum, financial obligations have been documented to have adverse health effects, just like complications from a medical service or procedure, and they should be disclosed to enable full patient autonomy in decision making.

In 2020, Congress finally recognized the ethical and social harms caused by surprise medical bills and enacted legislation designed to halt this most egregious incursion on patient autonomy. The No Surprises Act (NSA), effective January 1, 2022, prohibits certain out-of-network providers from billing patients inflated charges.17 Although some have argued that engaging in surprise billing was a violation of state contract and consumer protection laws,18 the NSA was a significant step forward in protecting patients from surprise medical bills. Critically, the NSA might also represent a major step forward in recognizing informed financial consent as a clinician obligation.17 In some circumstances, the act requires out-of-network clinicians to disclose prices to patients 72 hours in advance of an elective procedure if those clinicians want to avoid the payment dispute provisions of the act.17 This provision, together with the regulations implementing the NSA, provide a real-world template for the requirements of informed financial consent from a patient.

Achieving Informed Financial Consent

Adequate informed financial consent should include a legal commitment to providing patients with a price quote at or before the point of service. This commitment might seem like a sea change for US clinicians and provider organizations, but the concept of pledging to a price prior to providing a service should sound familiar to all of us—it is how we pay for goods and services in every other aspect of our lives. It is also a “common practice for self-pay clinical services such as direct primary care, elective plastic surgery, and laser-assisted in situ keratomileusis (LASIK) eye surgery.”17

Financial obligations have been documented to have adverse health effects, just like complications from a medical service or procedure.

We do not suggest that arriving at a specific price quote will be easy. Imagine that your physician offers you a colonoscopy for cancer screening. She describes the procedure and the risks, but she never provides a full description of the resources needed to administer the procedure: professional services, anesthesia, sterile supply, procedure room, recovery room, and pathology, if required. In truth, a colonoscopy is a specific bundle of services offered by different professionals and potentially different organizations (if the physicians are not employed by the hospital or ambulatory surgery center). Given the organizational complexity of care delivery, the United States has adopted a system of unbundling services and billing for each component of a service separately after the services have been provided. Thus, were prices to be bundled, all the clinicians and organizations providing a service would have to agree to the financial terms in providing the service. (Such an effort could be coordinated by the clinician or by the facility where the service is provided and could be negotiated on a period basis rather than for individual patients to make the process most efficient.)

Accordingly, requiring providers—both clinicians and provider organizations—to satisfy informed financial consent could lead to beneficial structural reforms in the broader payment system, as bundling payments would make obtaining financial informed consent much easier. For most services, the individual elements are predictable in a statistical sense, so constructing a standard bundle of services and charging for the bundle would not be challenging for most provider organizations. Provider organizations understandably worry that complications arising from a procedure could require additional resources. However, they should know how frequently such complications arise, and clinicians already address complication risk as part of their disclosure, so the financial implications of possible complications could be disclosed to patients as well as the bundled cost of the procedure. For example, if there were to be a perforation during a colonoscopy—a rare complication of the procedure—the fixed price for the procedure would not apply. In discussing the limits of the binding disclosure, the clinician could explain the potential cost implications of such complications. Depending on the risk of a procedure, deviations from the fixed-price estimate should be infrequent.

Pricing Transparency in Practice

In truth, even though discussions and knowledge of health care prices have been categorically separated from the delivery of care in the United States, making prices available should not be difficult. Payments for medical services, including a patient’s financial responsibility, are typically set by the contract between the hospital and the health plan. Many provider organizations now have a process to estimate the actual cost to the patient based on their health plan. These tools typically have a disclaimer that the estimates are not a price guarantee (eg, “Please note that pre-service estimates are based on average charges from similar patients. Your bill will be based on services you actually receive and may differ significantly from the average.”19). Moving from a cost estimate to a fixed priced thus would require minimal additional effort. One surgery center in Oklahoma has built an attractive business model around fixed, transparent pricing for clinical services.20

The US Department of Health and Human Services imposes similar price disclosure requirements on hospitals, which must “provide clear, accessible pricing information online about the items and services they provide in two ways: 1. As a comprehensive machine-readable file with all items and services. 2. In a display of shoppable services in a consumer-friendly format.”21 Although required postings are averages across patients and not a commitment to any individual patient, they still signal how price information can be compiled and disseminated. Within 20 months of the effective date, however, fewer than 20% of hospitals had meaningfully complied with these directives—let alone fully embraced the opportunity to inform patients seeking to economize on health care costs.22,23 Nevertheless, enforcement of these requirements could alleviate both financial distress and patient ignorance.

Informed financial consent can have other positive impacts on the health care system and the cost of care. Price transparency could empower consumers to shop for lower-cost services, and physicians and hospitals in turn would be under additional pressure to manage the costs and quality of individual clinical services. Finally, price transparency could exert pressure to lower costs from within organizations (eg, physicians trying to grow their practice needing a competitive price in the market) or from outside organizations (eg, shaming physicians and hospitals for excessive pricing schemes).

Need for Physician Leadership

Ultimately, the financial toxicity of health care is a problem that will never be solved without physician leadership. Patients are dependent on the skill of their physicians, and society relies even more heavily on the public spiritedness and scientific knowledge that the medical profession supplies. No amount of regulation can protect lay people from their dependence on physicians, which is ultimately why an ethical code of conduct emerged in the very earliest days of medicine as a profession.24 For the same reason, we now need physicians to assume their ethical obligations in matters of finance. Government regulations will not substitute for physician self-policing and ethical leadership. It’s time to address the harms associated with financial toxicity of health care by revising the AMA Code of Medical Ethics to address informed financial consent.

References

-

Zafar SY. Financial toxicity of cancer care: it’s time to intervene. J Natl Cancer Inst. 2015;108(5):djv370.

- Majhail NS. Long-term complications after hematopoietic cell transplantation. Hematol Oncol Stem Cell Ther. 2017;10(4):220-227.

- Lentz R, Benson AB III, Kircher S. Financial toxicity in cancer care: prevalence, causes, consequences, and reduction strategies. J Surg Oncol. 2019;120(1):85-92.

- Kluender R, Mahoney N, Wong F, Yin W. Medical debt in the US, 2009-2020. JAMA. 2021;326(3):250-256.

- Himmelstein DU, Lawless RM, Thorne D, Foohey P, Woolhandler S. Medical bankruptcy: still common despite the Affordable Care Act. Am J Public Health. 2019;109(3):431-433.

-

Addo FR. Seeking relief: bankruptcy and health outcomes of adult women. SSM Popul Health. 2017;3:326-334.

-

Cha AE, Cohen RA. Problems paying medical bills, 2018. NCHS Data Brief. 2020;(357):1-8.

- Ramsey SD, Bansal A, Fedorenko CR, et al. Financial insolvency as a risk factor for early mortality among patients with cancer. J Clin Oncol. 2016;34(9):980-986.

-

Appleby J. The case of the $489,000 air ambulance ride. Kaiser Health News. March 25, 2022. Accessed April 11, 2022. https://khn.org/news/article/the-case-of-the-489000-air-ambulance-ride

-

Code of Medical Ethics: consent, communication & decision making. American Medical Association. Accessed January 20, 2022. https://www.ama-assn.org/delivering-care/ethics/code-medical-ethics-consent-communication-decision-making

-

American Medical Association. Opinion 11.3.1 Fees for medical services. Code of Medical Ethics. Accessed April 11, 2022. https://www.ama-assn.org/delivering-care/ethics/fees-medical-services

-

Wager E, Ortaliza J, Cox C. How does health spending in the US compare to other countries? Peterson-KFF Health System Tracker. January 21, 2022. Accessed April 11, 2022. https://www.healthsystemtracker.org/chart-collection/health-spending-u-s-compare-countries-2/#:~:text=In%202020%2C%20the%20U.S.%20spent,from%2010%25%20in%202019

-

Tran LD, Zimmerman FJ, Fielding JE. Public health and the economy could be served by reallocating medical expenditures to social programs. SSM Popul Health. 2017;3:185-191.

- Bradley EH, Canavan M, Rogan E, et al. Variation in health outcomes: the role of spending on social services, public health, and health care, 2000-09. Health Aff (Millwood). 2016;35(5):760-768.

-

Arnold D, Whaley CM. Who pays for health care costs? The effects of health care prices on wages. Working paper WR-A621-2. RAND Corporation; 2020. https://www.rand.org/pubs/working_papers/WRA621-2.html

- Richman BD, Hall MA, Schulman KA. Overbilling and informed financial consent—a contractual solution. N Engl J Med. 2012;367(5):396-397.

- Richman B, Hall M, Schulman K. The No Surprises Act and informed financial consent. N Engl J Med. 2021;385(15):1348-1351.

- Richman BD, Kitzman N, Milstein A, Schulman KA. Battling the chargemaster: a simple remedy to balance billing for unavoidable out-of-network care. Am J Manag Care. 2017;23(4):e100-e105.

-

Personalized cost estimates. Duke Health. Accessed January 18, 2022. https://www.dukehealth.org/paying-for-care/estimate-care-will-cost

-

Surgery pricing. Surgery Center of Oklahoma. Accessed January 20, 2021. https://surgerycenterok.com/

-

Hospital price transparency. Centers for Medicare and Medicaid Services. Accessed January 18, 2022. https://www.cms.gov/hospital-price-transparency

-

Third Semi-Annual Hospital Price Transparency Report. Patient Rights Advocate.org. August 9, 2022. Accessed August 9, 2022. https://www.patientrightsadvocate.org/august-semi-annual-compliance-report-2022

-

Kliff S, Katz J. Hospitals and insurers didn’t want you to see these prices. Here’s why. New York Times. August 22, 2021. Accessed September 12, 2022. https://www.nytimes.com/interactive/2021/08/22/upshot/hospital-prices.html

- Riddick FA Jr. The Code of Medical Ethics of the American Medical Association. Ochsner J. 2003;5(2):6-10.